Tax season often feels like a frantic race against the clock. As a business owner, ensuring your contractors are paid is one thing, but reporting those payments to the IRS is an entirely different beast. If you are looking to print form 1099 and 1096 in QuickBooks Online 2026, you’ve come to the right place. Whether you are catching up on records to print form 1099 and 1096 in QuickBooks Online 2025 or staying ahead of the current year, this guide will walk you through the clicks and checks needed to stay compliant.

Master how to print form 1099 and 1096 in QuickBooks Online 2026. Get expert help for filing and QuickBooks errors at +1(866)500-0076.

Why Form 1099 and 1096 Matter

Before we dive into the "how," let’s clarify the "what."

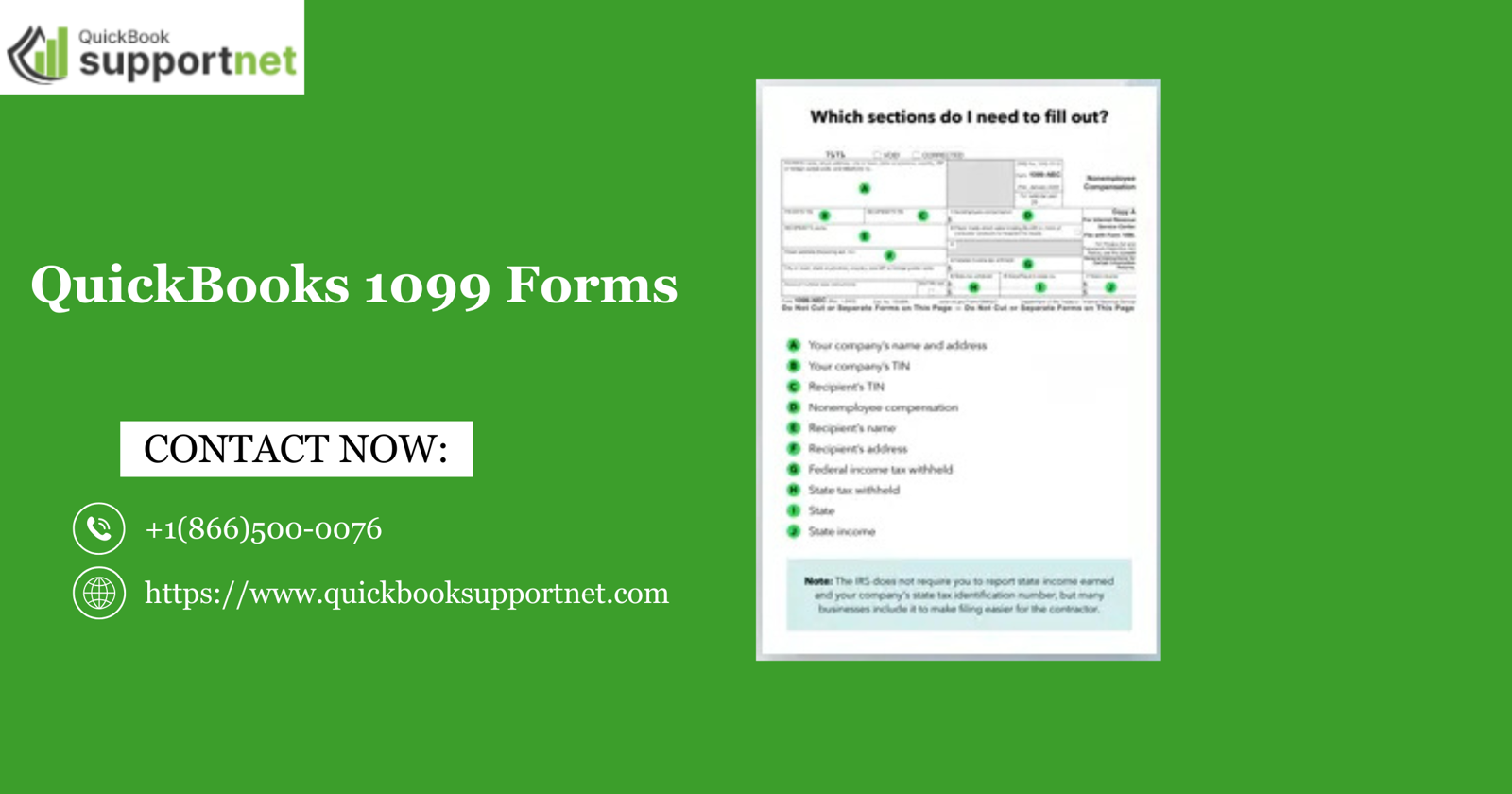

Form 1099-NEC/MISC: These are the forms you send to your non-employee contractors who you’ve paid over $600 during the tax year.

Form 1096: This is the "Annual Summary and Transmittal of U.S. Information Returns." Think of it as the cover sheet for your paper-filed 1099s.

Note: If you choose to e-file through QuickBooks, you generally do not need to print or mail Form 1096, as the electronic transmission handles the summary data for you.

Step-by-Step: Print Form 1099 and 1096 in QuickBooks Online

While many users look for ways to print form 1099 and 1096 in QuickBooks Online free, it is important to remember that while the software handles the data, you often need pre-printed IRS-approved paper if you aren't e-filing.

Step 1: Prepare Your Vendor Information

Before you can print 1099 form QuickBooks Online, your data must be pristine.

Go to the Expenses menu and select Vendors.

Review your list and ensure every contractor has a Tax Identification Number (TIN) or Social Security Number (SSN).

Check the box "Track payments for 1099" in each eligible vendor's profile.

Step 2: Navigate to the 1099 Wizard

Select Payroll (or Expenses) and then Vendors.

Click on Prepare 1099s at the top right of the screen.

Confirm your company information (Name, Address, and EIN).

Step 3: Categorize Your Payments

QuickBooks will ask you to map your chart of accounts to the specific boxes on the 1099 form. This is crucial to print 1096 quickbooks online accurately, as the 1096 totals everything based on these categories.

Select the accounts for "Nonemployee Compensation" (Box 1).

Select accounts for "Rents" or "Other Income" if applicable.

Step 4: Review and Verify

Review the list of vendors and the amounts QuickBooks has calculated. If someone is missing, it’s usually because their total payments fell below the $600 threshold or they aren't marked as a 1099 vendor.

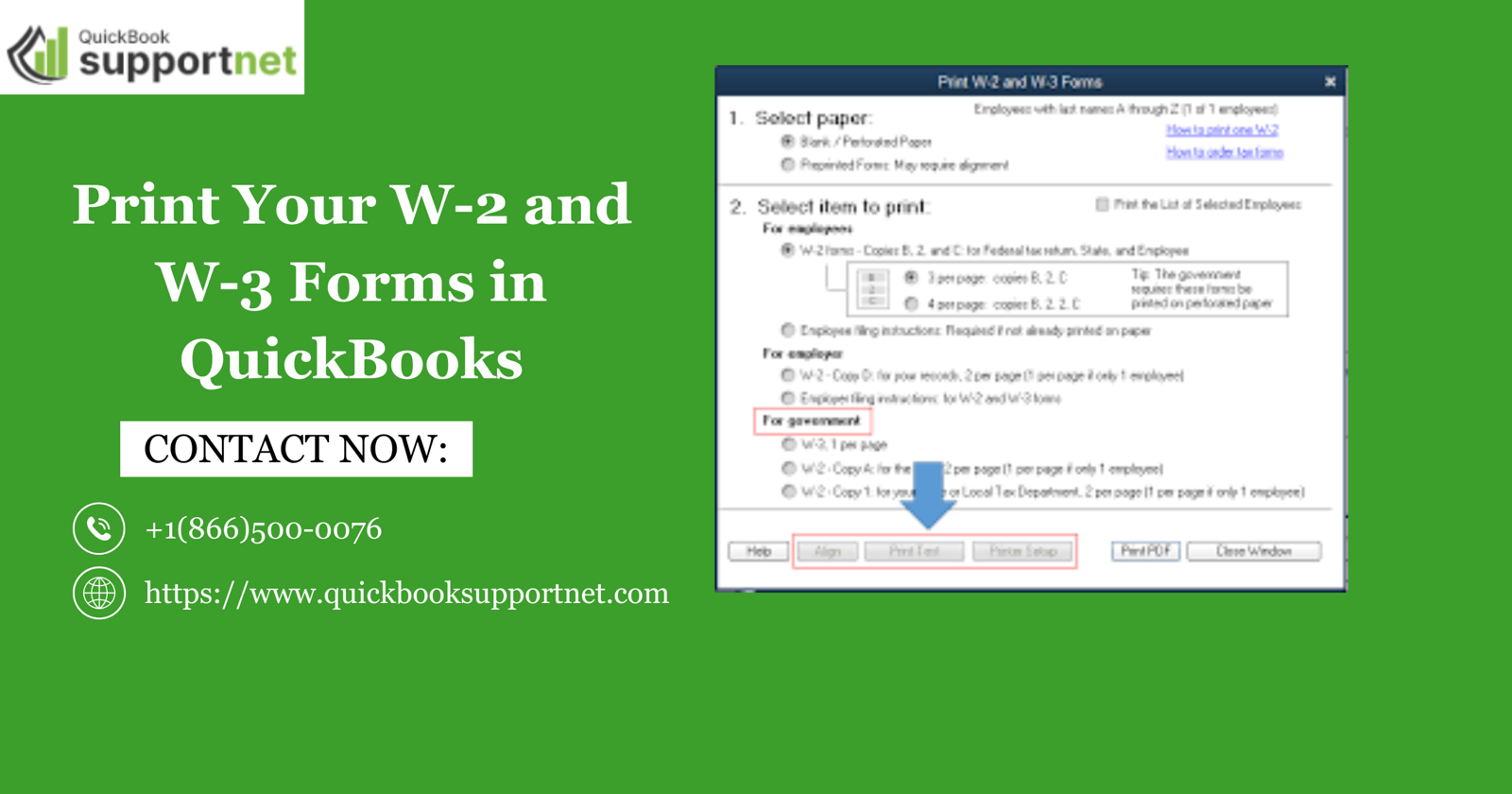

Step 5: Choose the Print Option

Once your data is verified:

Select Finish preparing 1099s.

Choose Print and mail (if you are not e-filing).

Follow the alignment tool prompts to ensure the text lines up perfectly with your physical forms. This is the final step to print 1096 form quickbooks online.

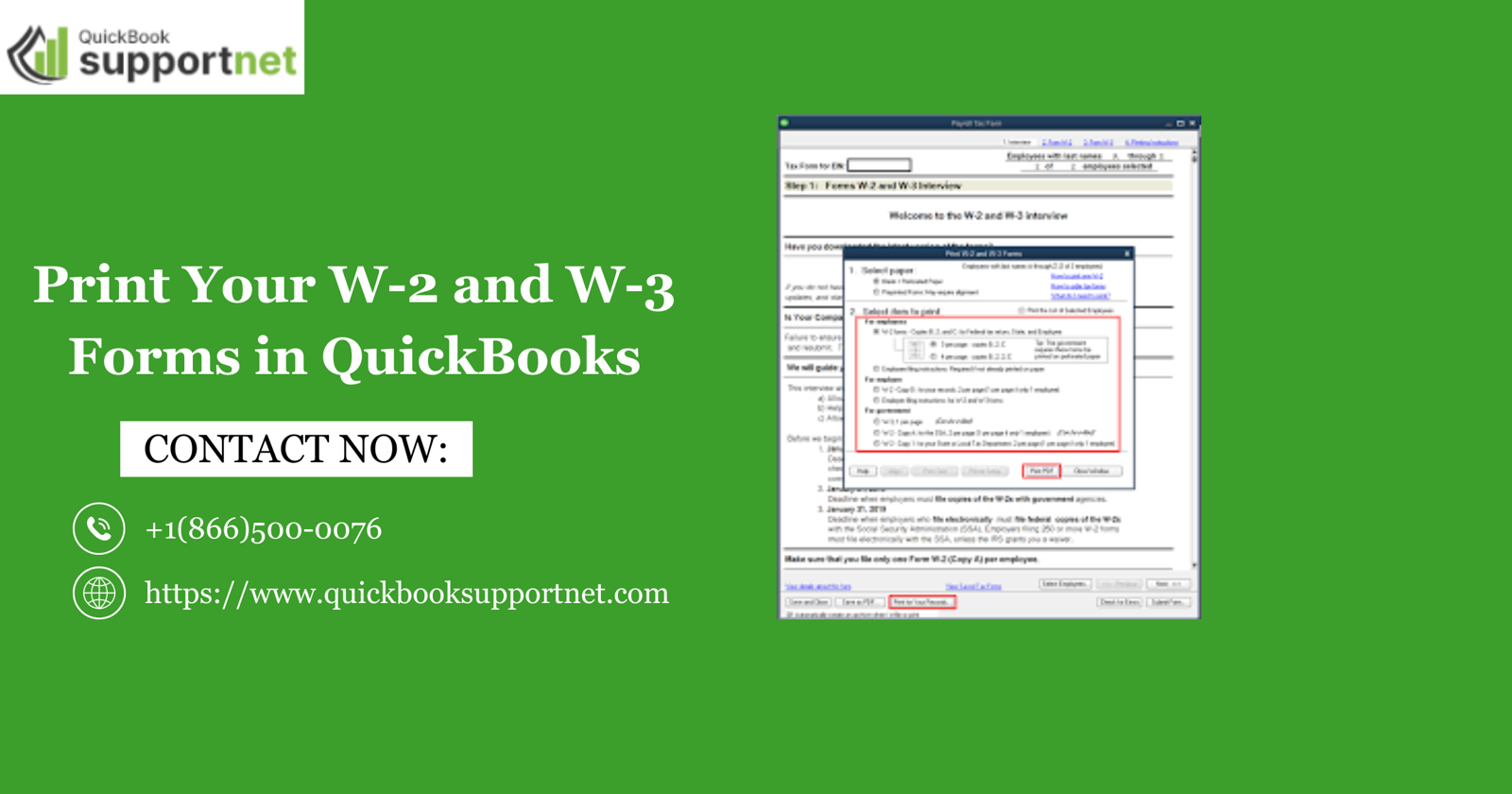

Must Read This Blog:- How to Print W-2 and W-3 Forms in QuickBooks 2026

Common Hurdles in the 2026 Tax Year

Every year, the IRS makes slight adjustments to forms. When you print form 1099 and 1096 in QuickBooks Online 2026, ensure your software is updated to the latest release. Many users struggle with:

Alignment Issues: Ensure your browser’s "Fit to Page" setting is turned off.

Missing Vendors: Double-check that payments were made via cash/check; credit card payments are reported by the bank via 1099-K.

Subscription Levels: Some versions of QuickBooks Online may require a specific subscription tier to access full 1099 reporting features.

Conclusion

Navigating the complexities of tax forms doesn't have to be a solo journey. While learning to print 1099 form QuickBooks Online is a valuable skill, technical glitches can happen. If you encounter software hangs, connectivity problems, or the dreaded QuickBooks Error 12038 during your update or filing process, don't let it stall your business operations. Our dedicated support team is ready to help you resolve errors and streamline your bookkeeping.

Still having trouble with your 1099s? Give us a call at +1(866)500-0076 for expert assistance with tax preparation and QuickBooks troubleshooting!

Frequently Asked Questions

1. Can I print form 1099 and 1096 in QuickBooks Online free?

QuickBooks allows you to generate the data, but printing on blank paper is generally not accepted by the IRS for Copy A. You must purchase the official pre-printed forms or use the QuickBooks e-file service, which carries a per-form fee.

2. Is Form 1096 required if I e-file?

No. When you e-file your 1099s directly through QuickBooks Online, the digital transmission replaces the need for a physical Form 1096.

3. How do I print 1096 form QuickBooks Online if I missed the prompt?

You can return to the "1099 Information" screen under the Vendors tab. Once the 1099s are marked as "prepared," you can re-access the print options for the 1096 summary.

4. What is the deadline for 1099s in 2026?

Typically, the deadline to provide 1099-NEC forms to contractors and the IRS is January 31st. Always check the current year’s IRS calendar for holiday adjustments.

Write a comment ...