The frost on the windows and the calendar flipping to January can only mean one thing for business owners: tax season has arrived. If you are looking to Print Your W-2 and W-3 Forms in QuickBooks, you are likely balancing a dozen tasks at once. Whether you are a seasoned pro or a new entrepreneur, ensuring your employees receive their wage statements accurately and on time is a top priority. In this guide, we’ll break down the "how-to" for both the Desktop and Online versions so you can breeze through your filings without the usual January headache.

Learn how to Print Your W-2 and W-3 Forms in QuickBooks +1(866)500-0076. Our 2026 guide covers Desktop & Online steps to ensure your tax season is stress-free.

Why Printing Early Matters

The IRS is strict about deadlines, usually requiring W-2s to be sent to employees by January 31st. By learning how to Print Your W-2 and W-3 Forms, you avoid last-minute rushes and potential penalties. Plus, QuickBooks 2026 has streamlined the interface, making it easier than ever to Print Your W-2 and W-3 Forms in QuickBooks Desktop and Online.

Step-by-Step: Print Your W-2 and W-3 Forms in QuickBooks Online

If you are using the cloud-based version, you’ll find that automation does most of the heavy lifting. However, you still need to know how to print w3 form quickbooks online for your own records or for manual filing.

Navigate to Taxes: Log in and select the Taxes menu, then click on Payroll Tax.

Access Filings: Select the Filings tab. Here, you will see a list of your tax forms.

Select W-2s: To print w3 in quickbooks online, look for the "Annual Forms" section and select W-2, Copies B, C & 2.

Choose the Period: Select the correct tax year (2025/2026).

View and Print: Click View to open a PDF copy. From here, you can use the printer icon to Print Your W-2 and W-3 Forms in Quickbooks Online.

Pro Tip: Make sure your pop-up blocker is turned off, as the forms open in a new browser window.

Deep Dive: Print Your W-2 and W-3 Forms in QuickBooks Desktop

For those who prefer the robust nature of the local software, the process to print w2 forms in quickbooks desktop is slightly different but equally straightforward.

Preparation Checklist

Before you print w3 quickbooks desktop, ensure:

Your QuickBooks is updated to the latest 2026 release.

You have downloaded the latest Payroll Tax Tables.

You have the correct 4-part or 3-part perforated paper.

The Printing Process

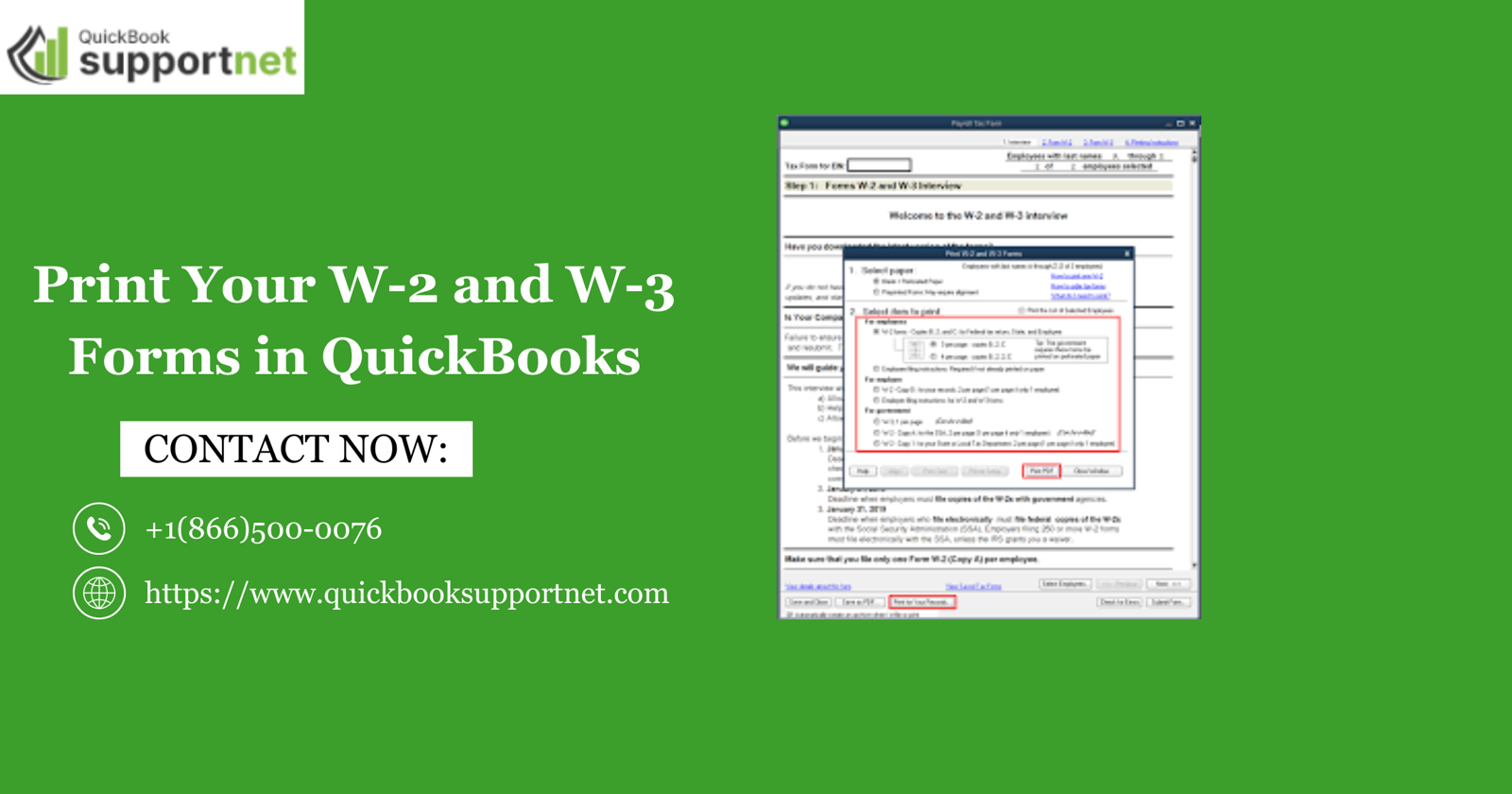

Go to Employees: Click the Employees menu and select Payroll Tax Forms & W-2s.

Process Payroll Forms: Click on Process Payroll Forms.

Select Form: In the "File Forms" tab, select Annual Form W-2/W-3 - Wage and Tax Statement/Transmittal and click Create Form.

Filter Employees: Choose "All Employees" or select specific individuals.

Review and Edit: It is vital to print w3 in quickbooks desktop only after reviewing the data for accuracy.

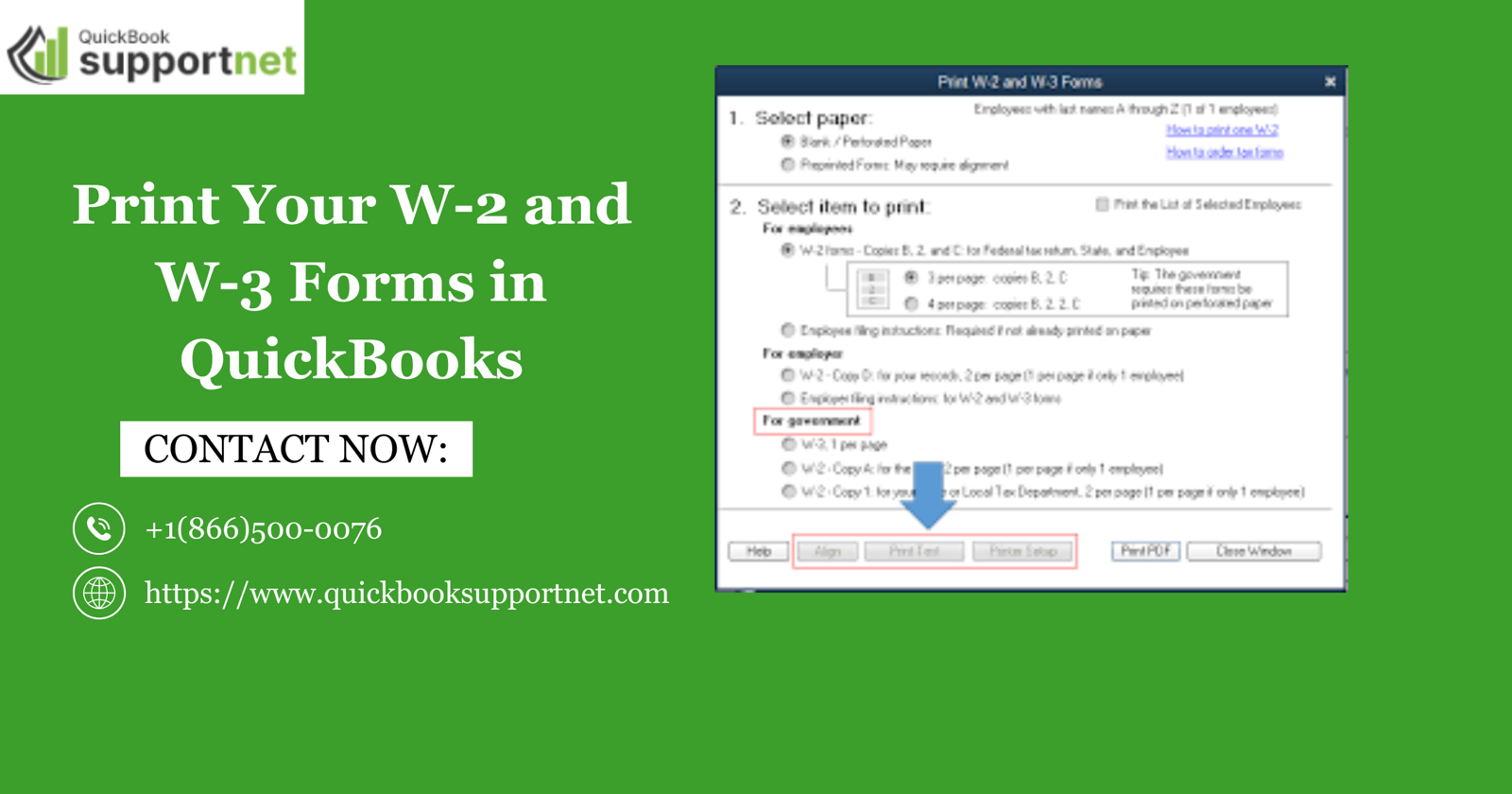

Final Print: Click Print/E-file. Choose your paper type (Blank or Pre-printed) and hit the print button.

Understanding the W-3 Transmittal Form

While W-2s go to your team, the W-3 is the "summary" sheet that goes to the Social Security Administration (SSA).

To print w3 form quickbooks online, follow the same path as the W-2 but select the "W-3 Summary" option.

To print w3 in quickbooks desktop, the W-3 is generated automatically when you process your W-2s.

Troubleshooting Common Printing Issues

Sometimes technology doesn't cooperate. If you find that the alignment is off or the "print" button is greyed out:

Check PDF Settings: Ensure Adobe Reader is your default PDF viewer.

Alignment Tool: Use the "Align" button in the QuickBooks print dialog to nudge the text into the correct boxes.

Active Subscription: Verify that your payroll subscription is active for 2026.

Conclusion

Successfully managing your year-end payroll is a sign of a healthy, organized business. Whether you need to Print Your W-2 and W-3 Forms for a small team of two or a large crew of fifty, QuickBooks remains the gold standard for getting the job done right. Remember to double-check your EIN and employee SSNs before hitting that final print button to avoid the dreaded "corrected" form process later.

If you are moving to the latest version and need help getting started, our team is here to assist. We can help you Register or Activate QuickBooks Desktop for Windows to ensure you have access to all the latest 2026 tax features and security updates.

Frequently Asked Questions

Can I print W-2s on plain white paper?

While you can print employer copies on plain paper, employee copies must typically be on IRS-approved perforated paper so they can be easily separated.

What is the difference between W-2 and W-3?

The W-2 is for the individual employee, while the W-3 is a summary of all employee earnings sent to the SSA.

Why can't I see the 2025/2026 forms yet?

Usually, forms become available in early January once the final tax tables are released by the IRS and updated in QuickBooks.

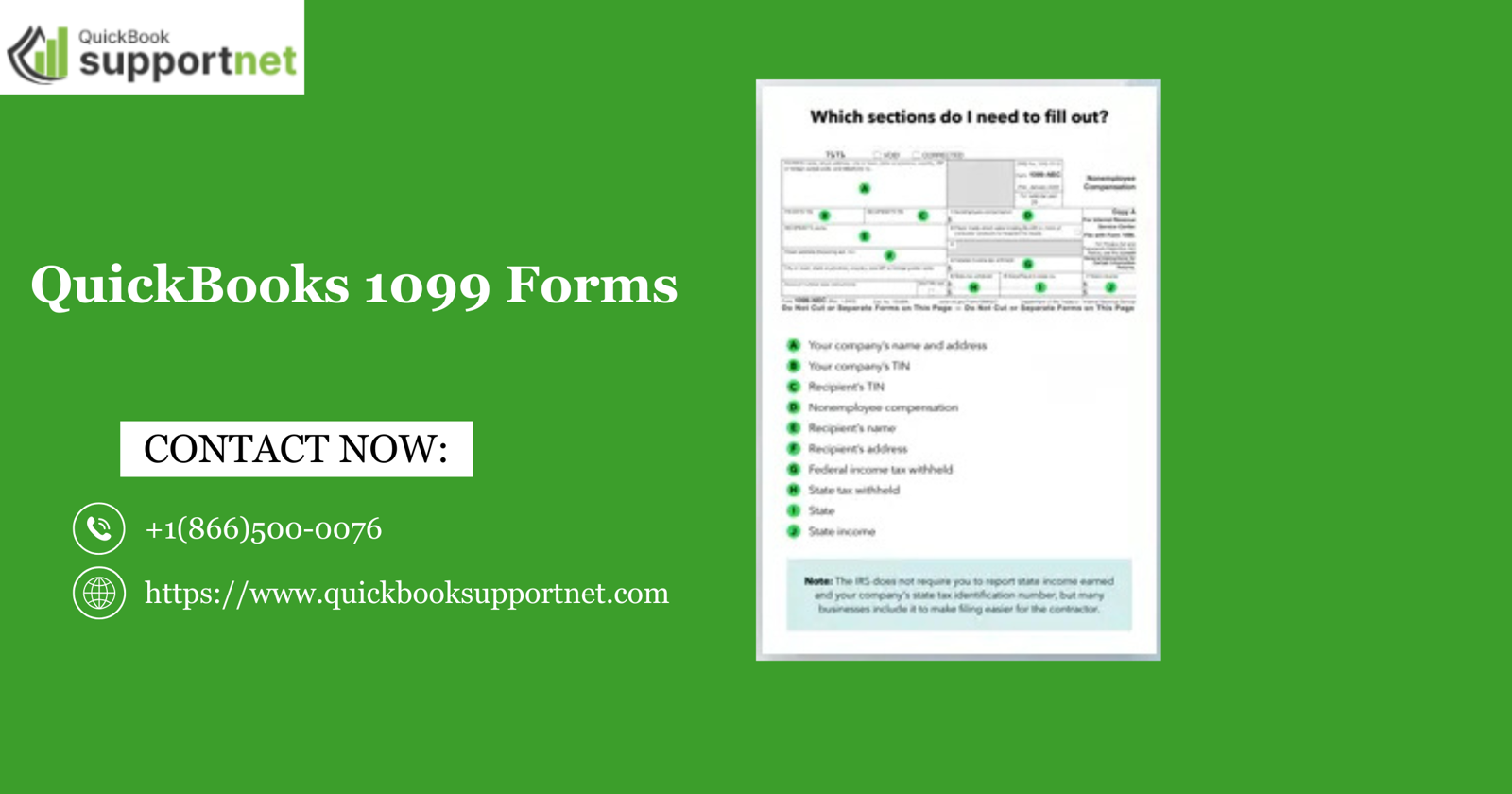

Read This Blog:- QuickBooks 1099 Forms Filing Process Guide 2026

Write a comment ...