Tax season doesn't have to be a season of stress. As we navigate the QuickBooks 1099 forms filing requirements for 2026, staying ahead of the curve is essential for every small business owner. Whether you are managing a handful of freelancers or a massive fleet of independent contractors, the quickbooks 1099 workflow has been refined this year to make compliance faster than ever. If you find yourself stuck at any point, professional assistance is just a phone call away at +1(866)500-0076.

Master QuickBooks 1099 forms filing in 2026. Step-by-step guide for Intuit 1099 e-file service. For expert help, call +1(866)500-0076.

In this comprehensive guide, we will break down how to use 1099 quickbooks tools to meet your obligations, leverage the intuit 1099 e-file service, and ensure your data is as accurate as a Swiss watch.

What’s New for 1099 Filing in 2026?

Before jumping into the "how-to," it is crucial to understand the "what." The IRS has introduced significant changes for the 2026 tax year. Notably, the reporting threshold for QuickBooks 1099 forms (specifically the 1099-NEC and 1099-MISC) has seen adjustments.

Higher Thresholds: Starting in 2026, the reporting threshold for many forms has increased from $600 to $2,000.

Mandatory E-Filing: The IRS now requires almost all businesses to file electronically if they have more than 10 information returns. This makes the intuit 1099 forms electronic portal more of a necessity than a luxury.

Digital Asset Reporting: If you paid contractors in cryptocurrency, 2026 brings stricter reporting via Form 1099-DA.

Step-by-Step: QuickBooks Online 1099 Filing Process

If you are using quickbooks online 1099 features, the process is largely automated, but it still requires a human eye for the final "ok."

1. Prepare Your Contractor List

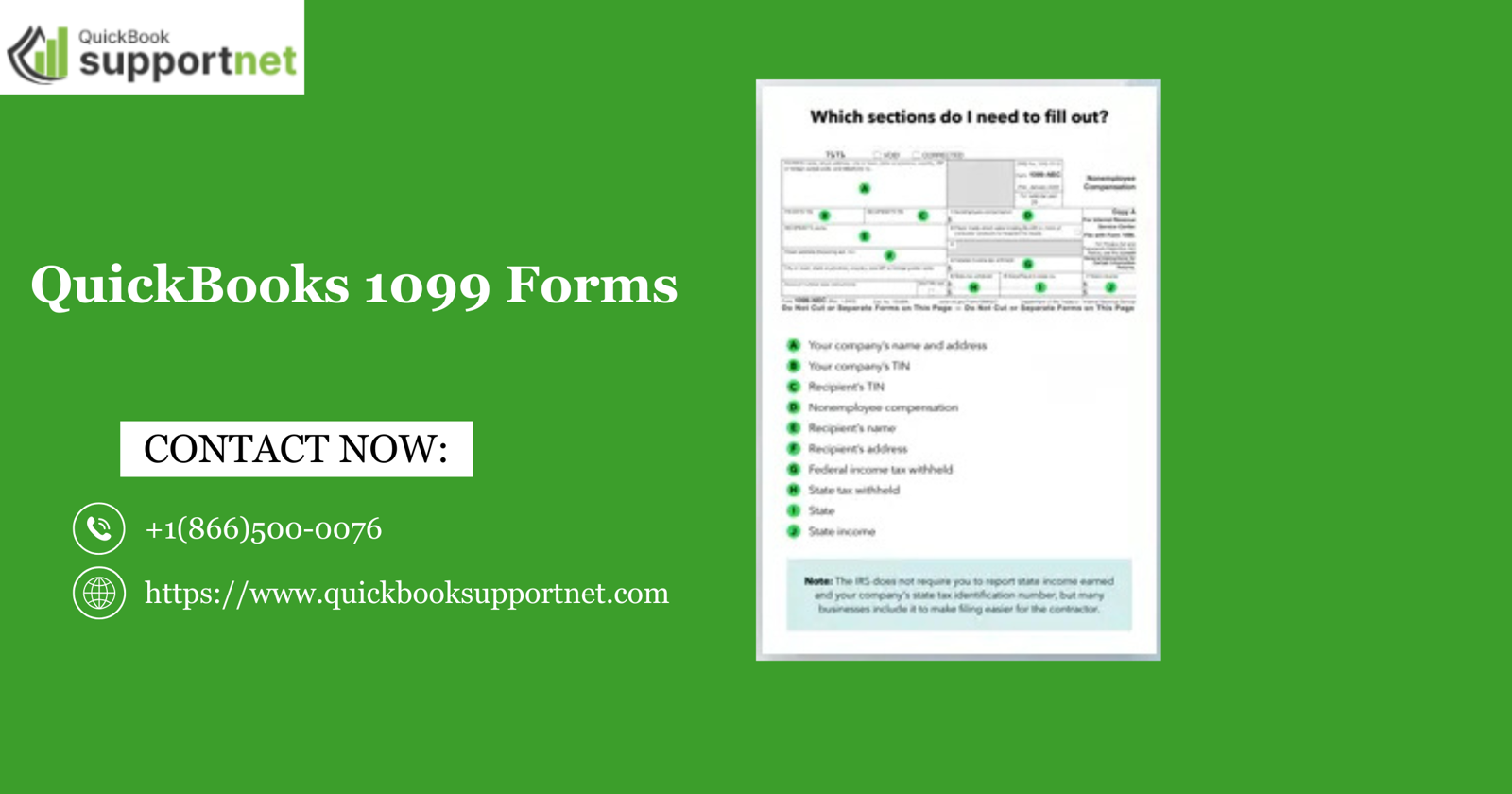

Go to the Payroll or Expenses tab and select Contractors. Ensure every person you paid has:

A valid Tax Identification Number (TIN) or SSN.

A complete physical address.

A valid email address (for digital delivery).

2. Map Your Accounts

This is where many users get tripped up. You must tell QuickBooks which "Chart of Accounts" categories (like "Legal Fees" or "Subcontractor Labor") should be included on the intuit 1099 forms.

Select Prepare 1099s.

Choose the accounts you used to pay your 1099-eligible vendors.

3. Review the Totals

QuickBooks will aggregate all payments made via cash, check, or ACH. Note that credit card payments are usually excluded because the bank (Form 1099-K) handles those. Review the "Reportable Total" for each contractor.

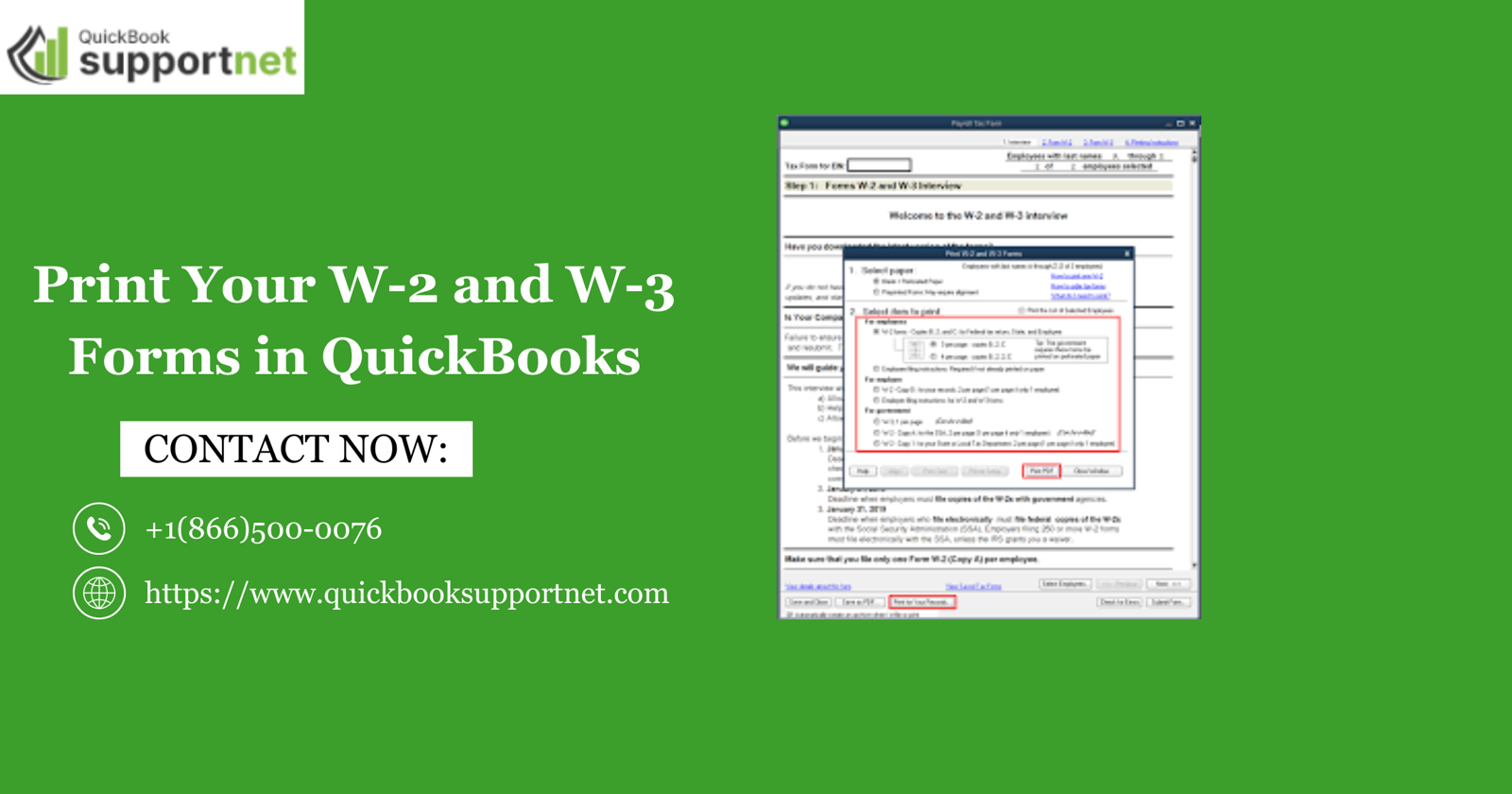

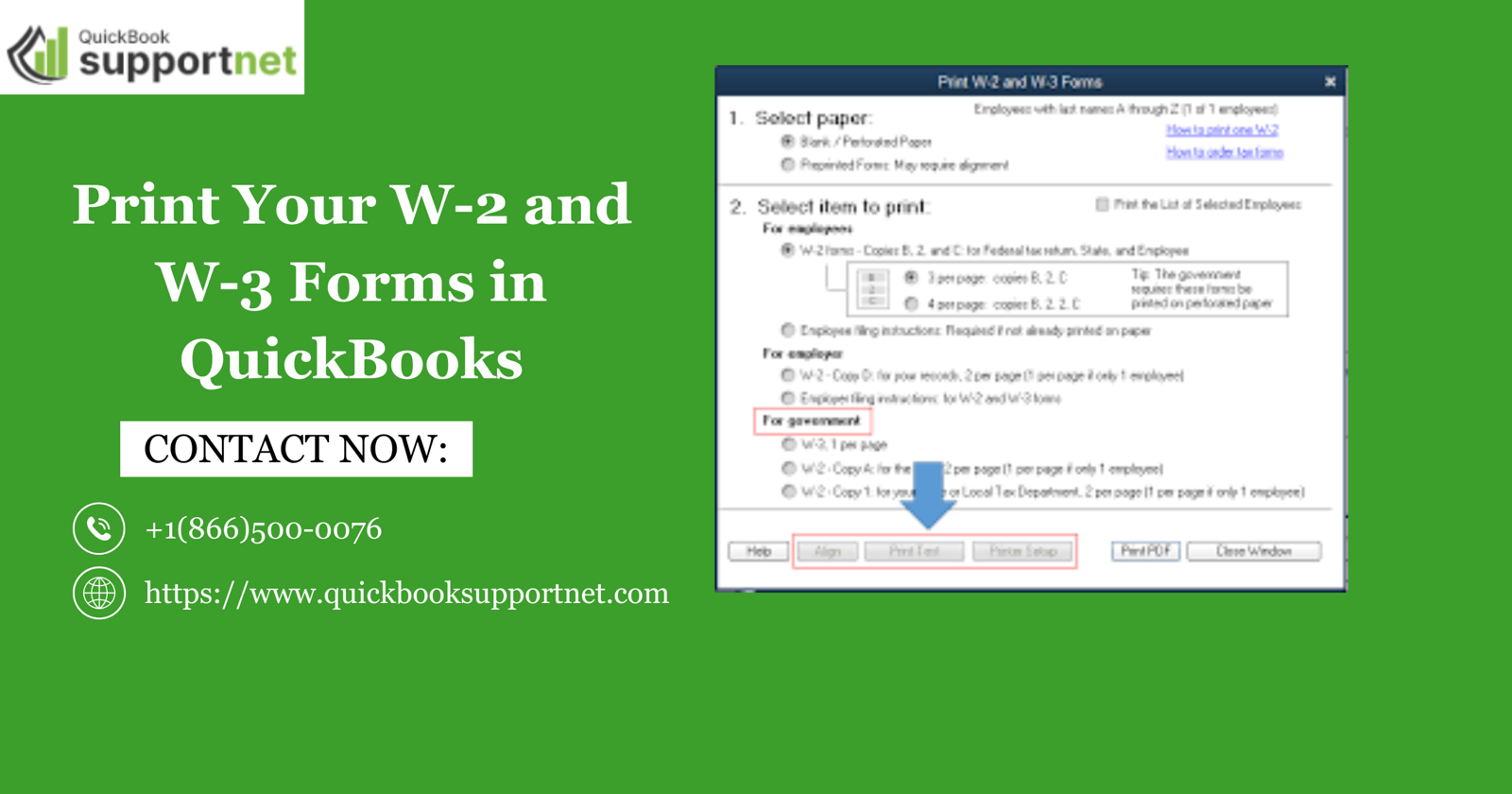

4. The Final Submission

Once the data is verified, select E-file. This utilizes the intuit 1099 e-file service, which transmits your data directly to the IRS and, in many cases, handles state filings simultaneously.

Why Use the Intuit 1099 E-File Service?

Manually printing and mailing forms is a relic of the past. Using the integrated quickbooks 1099 filing system offers several advantages:

Speed: Forms are delivered to contractors digitally in seconds.

Accuracy: The system checks for missing tax IDs before you hit submit.

Record Keeping: Your 1099 history is stored securely within QuickBooks for years.

Compliance: It automatically stays updated with the latest 2026 IRS tax codes.

Common Pitfalls to Avoid

Even with the best software, quickbooks 1099 errors can happen. Watch out for these common mistakes:

Duplicate Vendors: Ensure you don't have the same contractor listed twice under different names.

Wrong Form Type: Most contractors need a 1099-NEC (Non-Employee Compensation), while rent or royalty payments go on the 1099-MISC.

Missing Deadlines: The deadline for 1099-NEC is typically January 31, 2026. Missing this can result in hefty IRS penalties.

Also Recommended:- Print Form 1099 and 1096 in QuickBooks Online 2026

Troubleshooting: When the System Fails

Sometimes, technology has a mind of its own. If you encounter a QuickBooks Fatal Error during the e-filing process, it can be terrifying. This specific error often occurs due to corrupted data files or a loss of connection with the Intuit servers.

Expert Tip: If you see a "Fatal Error" message while trying to complete your quickbooks 1099 filing, do not keep clicking "Retry." This can lead to duplicate filings. Instead, restart your software, check your internet connection, or call the support line at +1(866)500-0076 for immediate technical assistance.

Conclusion

Navigating the QuickBooks 1099 forms landscape in 2026 is all about preparation and using the right tools. By leveraging the intuit 1099 e-file service, you save time and reduce the margin for error. Remember to verify your contractor data early in January to avoid the last-minute rush.

However, software isn't perfect. If you run into a QuickBooks Fatal Error or find that your quickbooks online 1099 totals aren't adding up, don't panic. Technical glitches are common during peak tax season, and expert help is available to ensure your business remains compliant and your stress levels remain low.

Frequently Asked Questions

Q1: What is the deadline for 1099-NEC in 2026?

The 1099-NEC must be filed and furnished to recipients by January 31, 2026.

Q2: Can I file 1099s for previous years in QuickBooks?

Yes, QuickBooks allows you to file for prior years, though you may need to use a specific manual workflow or a third-party add-on depending on your version.

Q3: Is the Intuit 1099 e-file service free?

Generally, there is a fee per form for e-filing, though some high-tier QuickBooks Payroll subscriptions include it in their monthly price.

Q4: What if I accidentally filed a 1099 with the wrong amount?

You will need to file a "Corrected" 1099. QuickBooks has a specific workflow for "Corrected" forms—simply select the form in your filing history and choose the correction option.

Q5: Who do I call for QuickBooks 1099 technical support?

For any filing issues or software errors, you can reach out to the dedicated support line at +1(866)500-0076.

Write a comment ...